Medicare Part D: Everything You Need to Know, and Probably Some You Don’t

Steph’s Note: This week, we welcome back our old friend, Cory Jenks. Previously, he’s been here on tl;dr talking about soft skills for pharmacists, how to be more adaptable, promoting his book (you have bought a copy, right?), and sharing his thrice weekly newsletter to help you get through your shift.

(Image)

But he’s back today to tackle a decidedly more clinical-adjacent topic: Medicare Part D. Even though tl;dr dipped our toes into this barrel of monkeys in our medication access post, it wasn’t until now that there was someone brave (insane?) enough to dedicate a full post to explaining the cluster that is Medicare Part D.

So Cory, please, for the love of Pete, can you clear up this insurance monster for us?

As someone who prides himself on following his own advice to step into a challenge, I left my career-long job working in the Federal Government to take a swing in the private sector last year. While the same clinical challenges of diabetes management remain, a new level of complexity emerged: private insurance and Medicare. A lot of my patients are, to be culturally sensitive, somewhat elderly. And I quickly learned that a lot of (or basically all of) my elderly patients utilize Medicare Part D for their prescription drug coverage.

Do you get as excited as the Target Lady when your meds are approved, because I sure do. (Image)

Back in my previous Federal Government life, I knew the formulary, ordered the med, and the patient got it. Easy-peasy. If I needed something off the formulary, I submitted a prior authorization with all of my amazing supporting documentation, and most of the time: approved!

In hindsight, it was pure magic! At least it feels that way compared to the wild west of Medicare Part D plans, with their different preferred meds, formulary tiers, and the dreaded “donut hole.” So I had two choices after starting my new job:

Sit and cover my face with my hands while rocking back and forth in a fetal position hoping Medicare would get easier, or

Challenge myself to independently research, write, and help tl;dr post an article so that you, intrepid reader, would need not join me in the fetal position.

What did I do?

I did what Barney Stinson would do.

This post is going to be, Legend-wait for it-dary. (Image)

Before going into what Medicare is, I thought it would be fun to hop in the WABAC Machine and give a brief history of how Medicare came into existence. While I could go into the all the “fun” details of the history of Medicare, this website is called tl;dr, and you ain’t got time for a long history lesson.

A (Very) Brief History of Medicare

In short, Medicare was born in 1965 and encompassed Parts A and B (don’t worry, you’ll know what they mean in a bit). The important part for you to know is that in its original form, there was no included prescription drug coverage.

Why, you ask?

“On the grounds of unpredictable and potentially high costs.” It’s like they got in a time machine and saw how much aducanumab would cost.

If you do want a long history lesson and the origin for that quote above, I recommend this very in-depth article, “A Political History of Medicare and Prescription Drug Coverage.” For our purposes, we’ll skip a lot of years (and political haggling) and say that prescription drug coverage, aka Medicare Part D, was enacted as part of the Medicare Modernization Act of 2003 and went into effect on January 1, 2006.

Cool, that’s a brief history of where Medicare came from. But with so much information, nuance, and “fun” involved with Medicare, I had a hard time figuring out where to start! After some initial research, I figured our government’s very own Medicare website, www.medicare.gov, would be a good place to begin an overview before getting into the nitty gritty of Medicare Part D.

So, what exactly is Medicare?

Coverages Provided by Medicare

In the most basic of terms, per the Medicare website, it is:

“The federal health insurance program for:

People who are 65 or older

Certain younger people with disabilities

People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD).”

Alright, so far so good. A Federal program to cover older people and a couple of other categories. Sounds pretty simple, right? Well, of course, there isn’t just one “The Medicare.” There are multiple parts of Medicare. In case you were wondering, they are:

Medicare Part A

Medicare Part B

Medicare Part C, which is usually called Medicare Advantage. It actually encompasses Parts A and B, sometimes with D, and a little extra B. Also, remember I before E, except after C. I’ll elaborate more on this in a bit.

Medicare Part D

While I don’t wish for there to be any more Medicare “parts” to make this more confusing, I sorta hope someday we get to Medicare Part Z, as it would lead to a Saturday Night Live sketch called “Medicare Z” that is just like one of my favorite sketches of all time - this commercial for a “Z Shirt” which is just every commercial trope from the 90’s.

Now that we have the Medicare parts, here is a brief description of what each one of them does. After that, I promise, we’ll get into what pharmacists (typically) care the most about - Part D.

Medicare Part A

Provides coverage for inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

The cool part about part A is that participants don’t typically pay a monthly premium as long as the participant or spouse paid Medicare taxes while working for a certain amount of time. This benefit of Medicare Part A is sometimes known as “Premium Free Part A.”

To make things a little more confusing…if a participant is not eligible for Premium Free Part A, they could possibly buy coverage. The cost is based on how many quarters the participant paid Medicare taxes, and it can be up to $506 per month in 2023. For example, if the participant paid Medicare taxes for less than 30 quarters, the standard premium is the $506, but if they paid Medicare taxes for 30-39 quarters, the premium drops to $278 per month.

Beating the house at the casino is probably easier than calculating Medicare premiums. (Image)

Still simple, right?

Medicare Part B

Provides coverage for certain doctors' services, outpatient care, medical supplies, and preventive services.

To make things a little simpler, everyone pays a premium for Part B. So if your Plan B was to pay nothing for Part B, you may want to look to a plan C (but not Medicare Part C, because you gotta pay for that one too).

Most participants will pay the standard Part B premium of $164.90 for 2023. However, because nothing can be too simple, if a participant’s modified adjusted gross income as reported on their tax return form (and are you paying attention?!) TWO years ago is above a certain amount, they pay the standard premium plus something called an “Income Related Monthly Adjustment Amount,” or IRMAA for funsies. They probably made it into a fun acronym like IRMAA because the reality is much less fun. Bottom line: it’s an extra charge added to the premium.

So after all of that, we surely will be moving onto the drug coverage, right? Well, sort of. Hurray?

Medicare Part C

Part C coverage is sometimes also known as Medicare Advantage. What does Part C cover? Well, it’s like A and B, sometimes D, but sometimes with more B thrown in for good measure.

What exactly is Medicare Advantage? I’ll be honest, I am not even to Medicare Part D, and I’m exhausted, so I am going to let the fine folks at www.medicare.gov explain in their words what Part C, or Medicare Advantage, is all about:

“Medicare Advantage is a Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage. These “bundled” plans include Part A, Part B, and usually Part D. Plans may offer some extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services…

All of this is making perfect, simple sense right? (Image)

Plans can also choose to cover even more benefits. For example, some plans may offer coverage for services like transportation to doctor visits, over-the-counter drugs, and services that promote your health and wellness. Plans can also tailor their benefit packages to offer these benefits to certain chronically-ill enrollees. These packages will provide benefits customized to treat specific conditions.”

Now, let’s just take a moment here.

If your head is spinning, imagine an 80-year-old with limited hearing, vision, and multiple chronic illnesses trying to decide what plan to choose. Heck, I was exhausted by Part C and had to call in for assistance to describe it!

See what I did there? I just injected some warm, cozy empathy into these cold, hard facts.

There is nothing Nacho Libre loves more than in depth analysis of Medicare Part D. (Image)

With all of that out of the way, let’s get down to the nitty gritty of Part D.

Medicare Part D

Part D helps cover the cost of prescription drugs (including many recommended injectables or vaccines). The drug benefits are provided by private insurance plans that receive premiums from both enrollees and the government. Wow, that was simple! Article over, right?

As the seemingly ageless Lee Corso would say:

Lee Corso definitely qualifies for Medicare. And a spot in the “National Treasure” discussion. (Image)

There is a lot nuance to exactly how Medicare Part D works. Probably more than is advisable for a tl;dr article. As with our history lesson, you are welcome to explore more in depth details on your own. But let’s cover the broad strokes of what you need to know and how it can make you a more effective pharmacist.

Let’s start with the cost.

In short, the wildly unsatisfying answer is, “It depends.” It depends on what Medicare Part D plan (or Medicare Advantage plan that includes prescription drug coverage) a participant chooses. According to the Kaiser Family Foundation, that means choosing from a menu of around 800 drug plans!

The number of plans available on a state-by-state basis ranges from 19 in New York up to 28 in my home state of Arizona. Think of picking a Part D plan like going to the Cheesecake Factory. Only instead of leaving filled with sugar and regret, you leave filled with confusing prescription drug coverage…and regret.

Heading back to our Medicare website, the actual cost a participant pays depends on a number of factors, including:

The monthly premium of the plan. This depends on the plan. Also, like Part B, if someone makes above a certain amount, they will pay an IRMAA on top of their premium.

The yearly drug deductible. This varies for Medicare Part D plans, but for 2023, the most it can be is $505. Some plans also don’t have a deductible…which is good! Some plans that do have a deductible don’t have deductibles for drugs on certain tiers…which can be complicated but also good! The bad news? The Frogurt is also cursed.

Copayment/coinsurance. This is the amount paid after the deductible is met. Paid by whom, you rightly ask? Well, the participant pays a share, and the plan pays a share to help with the cost of the medication. I hope you are sitting down, because this can get complicated. According to our Medicare.gov website…

“If you pay coinsurance, these amounts may vary because drug plans and manufacturers can change what they charge at any time throughout the year. The amount you pay will also depend on the tier level assigned to your drug…

Your plan may raise the copayment or coinsurance you pay for a particular drug when the manufacturer raises their price, or when a plan starts to offer a generic form of a drug, but you keep taking the brand name drug.”

I quoted it because I wanted to make sure I didn’t miss anything. And to highlight how absurd and confusing this may be to someone using Medicare Part D. At least for participants who spend a combined $4660 in 2023, they’ll pay no more than 25% of the cost for prescription drugs until out-of-pocket spending hits $7050. I can tell you my patients on $1000 GLP1 agonists love paying $250 dollars a month. Hurray?

Costs in the coverage gap or “donut hole” (more on that in a bit).

Catastrophic coverage. After the $7050 of out-of-pocket expenses, catastrophic coverage starts. The promise here is that the participant will only pay “a small coinsurance percentage or co-payment” for covered drugs for the rest of the year.

Part D late enrollment penalty. If you thought this would be a one-time penalty, you would be wrong. It’s not like a traffic ticket. If someone enrolls late for Part D coverage, their penalty depends on how long they went without Part D or creditable prescription drug coverage. How much is this penalty? Rather than screw up the maths, here is the equation direct from the website:

“Medicare calculates the penalty by multiplying 1% of the "national base beneficiary premium" ($32.74 in 2023) times the number of full, uncovered months you didn't have Part D or creditable coverage. The monthly premium is rounded to the nearest $0.10 and added to your monthly Part D premium…

The national base beneficiary premium may change each year, so your penalty amount may also change each year.”

My calculation? It’s probably good to enroll in coverage on time.

If you thought we were done with how much drugs will cost for participants, you would be wrong. Because, actually, the costs will also depend on additional factors, including:

If the participant’s medications are actually covered.

What “tier” their medications are in. This is your standard formulary tier for medications…which varies for each plan. There is not enough space in a tl;dr article to figure out each plan. Much like time in my work day, coincidently.

The phase of coverage they are in. For example, have they met their deductible, or are they in the coverage gap, aka the “donut hole.”

Which pharmacy the participant uses. Some pharmacies set up deals to be “preferred” and thus will charge less. Even if it means it’s not the patient’s preferred pharmacy, or even convenient for them. Hurraaay, again?

Whether the participant gets “extra help” paying for their coverage. Participants with low incomes and modest assets are eligible for cost sharing and assistance with their Part D premiums. It is called the Part D Low-Income Subsidy (LIS) and is available for Part D enrollees with low incomes. Specifically, per the Kaiser Family Foundation, this applied to incomes less than 150% of poverty, or less than $20,395 for individuals/$27,465 for married couples in 2022 and modest assets (up to $15,510 for individuals/$30,950 for couples in 2022).

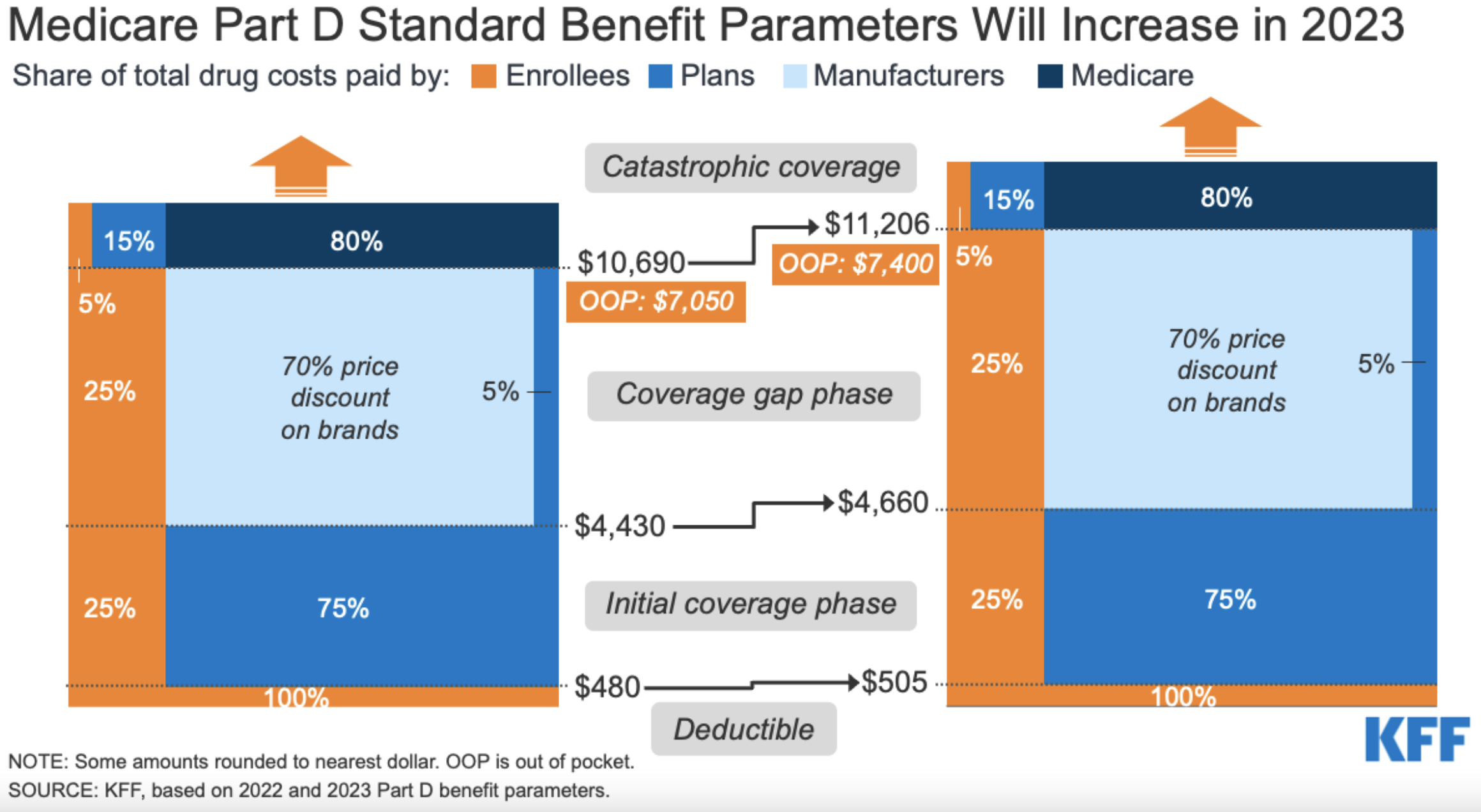

Whew, I need a break! How about this nice visual from our friends at Kaiser to break down the costs of Medicare Part D:

The left side is the breakdown for 2022, and the right side is 2023. (Image)

How is Medicare changing in 2023?

If you think we’re ready to wrap up, hold tight. I have a couple loose ends to tie up before you go forth and shine as Medicare Part D experts.

I’ll start with a happy loose end. Because if it feels like Medicare is a complicated beast that can leave you and your patients confused, angry, and hollow inside, you are not alone. But in 2023, there is a win for patients in the works.

If you spend any time around an outpatient clinic or pharmacy, you probably know that insulin can be a crazy big expense for patients. Well, starting in 2023, the cost for insulin in Medicare Part D plans will be capped at $35 per month. According to our faithful Medicare.gov website, plans will not be able to charge more than $35 for a one-month supply of each Medicare Part D “covered insulin” and can’t charge a deductible for insulin.

As Lambert Peng noted in his recent post on the 2022 Inflation Reduction Act, I also feel some trepidation about how this will all play out. I’ll caution with a “let’s see how well this works” approach. While I am not that old, I do have some gray hairs on my chinny chin chin, and lot less hairs on my scalpy scalp scalp, and so color me skeptical that this plan will roll out smoothly.

Also, the “covered insulin” terminology makes me a bit nervous that the scope of insulin products covered may be limited. And so, time will tell, but I think this is a great step forward for access for patients. My advice? You better study up on everything insulin.

What is the Medicare donut hole?

Alright, next… I mentioned earlier some “more in a bit” on the coverage gap. Well, welcome to “a bit.” Here is some “more.”

The Medicare Part D coverage gap, also sometimes referred to as the “donut hole,” is the point when spending reaches a certain amount from the plan and patient ($4660 in 2023). At this point, the patient has reached their coverage gap, or “donut hole.” All this means is that there is a temporary limit on what the plan will cover for medication.

Heading back to Medicare.gov, the implication is that, for brand name prescriptions, the participant will pay no more than 25% for their meds. Some plans may offer a lower price, but let’s work with the 25% figure for now. The “good news” is that while a participant will pay that 25%, 95% percent of the cost will count towards their total spending to help get them out of the donut hole. For the specific breakdown, I am again going to quote Medicare.gov so I don’t mess up the maths for you:

Of the total cost of the drug, the manufacturer pays 70% to discount the price for you. Then your plan pays 5% of the cost. Together, the manufacturer and plan cover 75% of the cost. You pay 25% of the cost of the drug.

There’s also a dispensing fee. Your plan pays 75% of the fee, and you pay 25% of the fee.

What the drug plan pays toward the drug cost (5% of the cost) and dispensing fee (75% of the fee) aren't counted toward your out-of-pocket spending.

Got all that?

Well, you may be wondering what about those generic drugs? The math is a little easier on that front. Medicare pays 75% of the cost for the generic, with the participant paying the remaining 25%, and only that 25% paid counts towards getting out of the gap.

If you are sitting there trying to make this math work while your head spins, you may be wondering why in the world there would even be a coverage gap? Well, the original goal was to utilize the invisible hand of economics to incentivize the use of generic drugs to help keep costs lower. I think this was a noble goal, and the use of generics whenever possible is a fantastic approach to limiting costs and providing effective, economically viable care.

Getting out of the donut hole involves hitting your catastrophic limit of spending ($7400 in 2023). Once there, the cost eases significantly as Medicare Part D will leave you paying 5% of the cost of brand or generic meds, or $3.70 for generics and $9.20 for brands, whichever cost is higher (btw, these are 2022 numbers).

Yes, 2022 is old news, but this shows a reasonably simple visual of how the donut hole works. And it has sprinkles! (Image)

If you are an optimistic person like me, you like to think the future is bright. And when it comes to catastrophic coverage, there is relief on the horizon…

Starting in 2024, people who reach the catastrophic coverage limit won’t have to pay any cost sharing, and if you are reading this in 2025, first, please let me know how your hover cars and teleportation devices are going. Second, you and your patients will enjoy not having to spend more than $2000 dollars per year (and subsequently indexed for inflation) in out-of-pocket costs for medications covered by Medicare Part D.

Get those shades ready because the future is bright, baby.

Unlike Homer, eating donuts will not get you out of Medicare donut hole hell. (Image)

But we live in the right here, right now. There are still coverage gaps, and what if there is only a brand name drug in the class? And what if the patient has limited resources? How do you get out of donut hole hell? Or at least survive it until you reach the catastrophic limit…

I am going back to the well one more time with our friends at Meciare.gov. They provide five suggestions to help with medication costs. Let’s break em’ down:

Consider switching to generic drugs or a lower cost brand name. A noble thought, and the original intent of the donut hole. But it’s not exactly realistic for your patients with heart failure on an ARNI or your patients with diabetes (or heart failure!) on an SGLT2 inhibitor or GLP1 agonist. Not to mention any number of other brand spankin’ new brand only meds! My advice? Rely on generics as much as possible and keep listening to this list.

Choose a Medicare drug plan that offers additional coverage during the gap. This is great advice…except when it’s not. Like when those types of plans have higher monthly premiums to get this benefit, and patients can’t afford that cost. Or if a patient starts the year on no meds, has some large health event partway into the year, and is stuck with their old plan until open enrollment. It also assumes someone will be savvy enough to navigate finding a plan that fits their needs well. And we all know what happens when we assume, right?

Use patient/pharmaceutical assistance programs. Some drug companies offer free medications (yes, even the branded ones) to patients on Medicare who fall below certain income thresholds. This approach has been my go to - with some success. The process can take weeks, and getting a hold of the companies to check status often involves a lot of dancing to long stretches of hold music. But it is well worth it to help patients save thousands of dollars. A great resource to find these programs is Needy Meds or the brand name drug website.

State pharmaceutical assistance programs. File this under the “you learn something new every time you write an article for tl;dr.” According to Medicare.gov, some states may have specific med assistance programs, and you can search them here.

Apply for Extra Help. There is a specific program called “Extra Help” through Medicare and Social Security that is for individuals with limited income and resources. If the person qualifies, they’ll pay (in 2023) $4.15 for each covered generic and $10.35 for a covered brand med. More info can be found here.

The tl;dr of Medicare Part D

Wow, that was a lot. And I am sure there is more to it. If you take anything away from this article, other than the superb overview I provided and that you will now be better pharmacists for it, it is this:

Remember who Medicare Part D covers: our patients over 65. I don’t know about you, but I have seen my parents work their smartphones, computers, and try to find anything on an internet search engine. They are well-educated, lovely, and relatively healthy older people, and they still struggle with that sort of technology and planning.

Try to put yourself in your patients’ shoes and imagine how challenging and frustrating it is for them to navigate such a complex program. Throw in a little lower level of health literacy on top of financial constraints, and you have the recipe for some dangerous outcomes.

That is until you are able to step in and provide the incredible, compassionate care I know you are capable of!

This article won’t fix the issues and challenges of Medicare Part D, but I hope it gives you a tool in your pharmacy superhero tool belt to help your patients along the harrowing journey of prescription drug coverage.